The Silver Tsunami Myth: Why the US Real Estate Market Won't Crash in 2026

What is the "Silver Tsunami" in Real Estate?

Before diving into the 2026 market data, it is crucial to understand one of the most talked-about theories in the housing sector: the "Silver Tsunami."

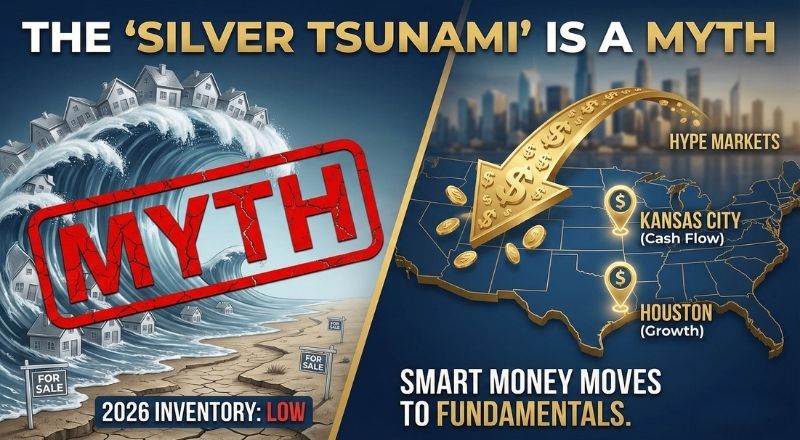

For the past five years, real estate economists and analysts have warned of a massive demographic shift. The theory suggested that as the "Baby Boomer" generation (who currently own about 45% of total US real estate wealth) aged, they would collectively decide to downsize or move into assisted living facilities around 2025.

The prediction was that this mass exodus would flood the real estate market with millions of homes for sale, drastically increasing real estate supply and causing real estate prices to crash.

The "Great Real Estate Sell-Off" That Isn't Happening

The data for the 2026 real estate cycle is finally in, and it proves the "Silver Tsunami" theory wrong. The anticipated crash in the real estate market is simply not happening.

According to the latest real estate market analysis, 61% of Boomers have absolutely no plan to sell their real estate assets. Instead, they are choosing to "age in place," retrofitting their existing properties for accessibility. Furthermore, they are holding onto their historical low mortgage rates (around 3%)—a financial advantage they would lose if they sold their real estate now.

What This Means for Real Estate Investors

The "flood" of cheap real estate inventory isn't coming. The shortage of available homes in the US real estate market is here to stay. For a serious real estate investor, the message is clear: You cannot wait for a market crash. You must find specific real estate markets where the numbers work right now.

A Tale of Two Real Estate Markets: "Hype" vs. "Fundamentals"

Many foreign and out-of-state real estate investors make a fatal mistake: they treat the US "Sunbelt" as one single real estate market. It isn't.

While "Hype Real Estate Markets" like Austin, Texas, and Miami, Florida, are seeing price corrections and skyrocketing insurance costs, "Fundamental Real Estate Markets" like Houston and Kansas City are quietly outperforming them.

In Q4 2025, we tracked the net migration of real estate capital. The data shows that smart money is moving away from speculative appreciation plays and toward Real Estate Cash Flow.

The Numbers: Real Estate Hype vs. Real Estate Reality (2026 Projection)

The Grit Strategy: The "Hybrid" Real Estate Portfolio

The smartest real estate investors in 2026 are building what we call a "Hybrid Real Estate Portfolio." This strategy mixes the stability of the Midwest real estate market with the growth potential of specific Sunbelt pockets.

-

Kansas City (The Real Estate Yield King): The Midwest offers recession resistance. You can buy excellent 3-bedroom real estate assets for under $275k with strong rental demand driven by the logistics and tech sectors growing in Missouri.

-

Houston (The Real Estate Growth Engine): Unlike Austin, the Houston real estate market remains affordable. It creates jobs faster than almost any city in the US, driving consistent tenant demand without the "bubble" prices seen in neighboring real estate markets.

How Grit Property Group USA Helps You Execute Your Real Estate Strategy

Identifying a real estate trend is easy; executing a real estate transaction from another country (or state) is the hard part.

At Grit Property Group USA, we specialize in helping international and out-of-state real estate investors build profitable US portfolios without the headache. We don't just send you a Zillow link; we handle the entire real estate ecosystem.

The Grit Real Estate Advantage for 2026:

-

Foreign National Real Estate Finance: We partner with top US lenders who can offer up to 50-70% Loan-to-Value (LTV) loans specifically for foreign real estate investors. You don't need a US credit score to get started in US real estate.

-

Boots on the Ground: We have active real estate teams in key markets like Kansas City and Houston. We inspect the real estate assets, verify the neighborhoods, and ensure you aren't buying a bad property.

-

Full "Turnkey" Real Estate Service: From forming your US LLC (Limited Liability Company) to connecting you with our in-house real estate property management teams, we handle the compliance so you can focus on your real estate returns.

-

Immigration Support: For clients looking to move, we even connect you with legal experts for investment-based visa pathways through real estate.

Stop forcing deals in overheated real estate markets. Let Grit help you move your capital to where the real estate cash flow is.

Contact Our US Real Estate Investment Team

Grit Property Group USA

📍 Headquarters: 142 West 57th Street, New York, NY 10019

📞 Call: +1 646-325-2270

🌐 Website: www.gritpropertyusa.com